What is an HSA and How Does it Work?

Despite the implementation of the Affordable Care Act (ACA), healthcare is more expensive in the United States than ever. In 2020, the average health insurance monthly premium was $456 for individuals and $1,152 for families of two or more[1].

Those numbers increased 68% and 73%, respectively, from what they were during the ACA’s first nationwide enrollment period in 2014. That’s nearly four times the rate of inflation, which has many people in desperate need of a more affordable alternative[2].

A Health Savings Account or HSA can’t replace your costly insurance policy alone, but it can play a vital role in developing a more affordable healthcare strategy. Here’s what you should know about HSAs, including how they work, how to use them, and when they’re a good idea.

What is an HSA?

An HSA is a tax-advantaged account that essentially subsidizes your medical costs. Your contributions, returns within the account, and withdrawals for qualified medical, dental, or vision expenses are all tax-free.

Unlike many other tax-advantaged accounts, HSAs aren’t designed for retirement. You don’t have to meet a minimum age threshold to take your funds out and spend them, as long as you’re making a withdrawal for eligible healthcare services.

That includes things like deductibles, copays, and prescriptions for your spouse, children, or other qualified dependents. There are limits, though. For example, the expenses only qualify if you incur them after establishing your HSA, and health insurance premiums don’t qualify unless they’re for Medicare or COBRA.

If you take money out of your HSA and spend it on anything other than qualified medical expenses, you’ll pay ordinary income taxes on your withdrawals. If you do so before you turn 65, you’ll also incur a 20% penalty.

📗 For a detailed breakdown of eligible HSA expenses, review IRS Publications 502 and 969 or a list from a health insurance provider like Cigna.

Who Can Open an HSA?

Unfortunately, not everyone is eligible to open an HSA. To qualify, you must have a High Deductible Health Plan (HDHP) that meets specific Internal Revenue Service (IRS) requirements. These include:

- A minimum deductible of $1,400 for self-only plans and $2,800 for a family plan.

- A maximum out-of-pocket amount of $7,050 for self-only plans and $14,100 for family plans.

- The plan can’t provide benefits other than preventive care until you meet your deductible.

In addition, you generally can’t have other health coverage, including Medicare, and no one can be able to claim you as a dependent on their tax return.

⚠️ When you shop for an HDHP on the ACA marketplace, it tells you whether or not it’s eligible for an HSA. Make sure you double-check before committing since you can’t change your mind until the next enrollment period.

How Do HSAs Work?

HSAs work similarly to many other tax-advantaged accounts. You contribute your funds, they grow within your account, and you take them out when you need them. However, some aspects of the process are unique to HSAs. Here’s a more detailed explanation of the mechanics.

Setting Up an Account

If you’re an employee and get an HSA-eligible HDHP through your company, they may offer you an HSA too. If you don’t like its terms or are self-employed, you can also open an HSA independently.

The HSA Search tool lets you compare hundreds of providers. To find the best option for you, review each account’s fees, investment options, and various features. For example, some HSAs don’t let you spend the funds in them directly.

Contributions

If your HDHP has self-only coverage, you can contribute $3,650 per year to your HSA. If your HDHP also covers one or more family members, you can contribute $7,300 per year. In both cases, people over 55 get an additional $1,000 catch-up contribution.

Your employer or spouse can also contribute, but the same annual limits apply. Even if both spouses have HSAs and qualify for family coverage, they can only contribute a combined $7,300 per year between both accounts.

⚠️ These are the limits for the 2022 tax year, but the numbers increase with inflation over time.

To put money in your HSA, you can set up a payroll deduction with your employer (if the account is through them) or transfer funds from a bank account. The former option excludes the contributions from your wages, making them completely tax-free.

If you make the contributions directly, you must deduct them from your gross income when you file your taxes. That lets you avoid paying federal and state taxes on the amount, but you’ll still incur the 7.65% FICA tax for Social Security and Medicare.

Investing Within the Account

Each HSA has its own investment options. Some merely provide a small return like a savings account, while others let you purchase certificates of deposit, stocks, or mutual funds.

Keep your time horizon in mind when you decide how to split your funds. For example, if you think you’ll need the money in a few years, you probably don’t want it all in mutual funds.

Withdrawals

There are also two general ways to take funds out of your account. You can spend them directly with a debit card linked to your HSA, or you can pay for expenses out of pocket and reimburse yourself later.

Fortunately, if you choose the latter, there’s no deadline. You can seek reimbursement years later if you want. That can be a beneficial strategy since it lets your assets grow within the account for longer.

Either way, keep careful records of all your medical expenses. If the IRS audits you, you need to prove that you used the funds for eligible healthcare services to keep your tax benefits.

Tax Savings

HSAs are unique in that you can get a deduction for your contributions and potentially pay no tax on your withdrawals. Other tax-advantaged accounts only allow one or the other. Because the assets inside grow tax-free as well, you can get a triple tax benefit from your HSA.

Say John is single and earns $75,000 a year, making his highest federal tax bracket 22%. He lives in a state with no income tax. John is employed but has to open his HSA with a third party and make direct contributions. The account has no monthly fees and lets him invest his contributions in mutual funds.

John decides to contribute $3,000 to his HSA annually for a decade. In the 11th year, he pays for $25,000 of qualified medical expenses using a debit card attached to his HSA. John would reduce his tax burden by the following amounts:

- $3,000 contributions multiplied by a 22% tax bracket for ten years equals $6,600

- $25,000 tax-free withdrawals at a 22% marginal tax bracket equals $5,500

As a result, John stands to save $12,100 in federal taxes, which would help mitigate his healthcare costs. In addition, John would avoid paying taxes for any capital gains or dividends his assets earned while in the HSA.

📗 Learn More: To use an HSA properly, you need to understand how taxes work for individuals. Check out our deep dive into the subject: Taxation 101: How Do Taxes Work For Individuals?

How to Use an HSA and HDHP for Healthcare

In certain situations, combining an HSA with an HDHP can be a great way to make your healthcare more affordable. Fortunately, using them together is also relatively simple. You can separate the long-term strategy into two distinct phases.

First is the accumulation phase, during which you don’t need much medical care. As a result, a high deductible doesn’t bother you, and you can take advantage of your lower monthly premiums to maximize contributions to your HSA.

💡 It’s a good idea to keep a sizable emergency fund during this period. If you end up needing more medical care than you expected, you want to be able to cover your HDHP’s deductible.

Second is the withdrawal phase. Once you reach an age where your medical needs increase, you can start taking the funds out of your HSA to pay for healthcare as necessary.

You or someone in your family will likely incur medical expenses at some point. However, even if you don’t use all the HSA funds for healthcare, the 20% penalty for spending the money on other expenses goes away at age 65.

If you find yourself in that situation, the account works just as well as any other tax-advantaged retirement account. You’ll pay ordinary income taxes on your withdrawals, but that’s true of a traditional 401(k) and Individual Retirement Account (IRA) too.

When is an HSA a Good Idea?

Leveraging an HSA can be a great way to make your healthcare more affordable, but it’s not the right choice for everyone. Here’s what you should consider before you decide to switch to an HDHP and open an HSA.

Advantages of an HSA

As we’ve discussed, the primary advantage of using an HSA and HDHP combo is that it can mitigate the cost of your medical services by reducing your monthly insurance premiums and overall tax liability.

HSAs are the only accounts that offer a threefold tax benefit. You get an upfront deduction, tax-free growth within them, and tax-free withdrawals for qualified medical expenses.

The second significant advantage of an HSA is its versatility. You, your spouse, and your employer can all contribute. You have the option of using paycheck deductions or direct transfers.

Once your money is in the account, you can often invest in a wide range of assets, including certificates of deposit, stocks, and mutual funds.

Next, you can take the money out at any time without penalty for your family’s medical expenses. Again, you have the choice to spend the funds directly or reimburse yourself with them years after the services occur.

Finally, if it turns out that you have more money in the account than medical expenses, you can use the leftovers as retirement funds without penalty after age 65.

Disadvantages of an HSA

There are few legitimate downsides to an HSA. You have to document your medical expenses, and some people argue HSAs make you more reluctant to spend on healthcare when you need it, but those are relatively easy to overcome.

The real risk is that you have to sign up for an HDHP. If you end up needing significant medical services during the accumulation phase, you’ll be on the hook for an expensive deductible. If that occurs before you have time to build up money in your HSA, you could blow through your cash savings and end up in medical debt.

Who Should Consider an HSA?

Generally, an HSA is best for young, healthy individuals who rarely need to seek out medical care. Ideally, you’d also get an account through your employer so you can contribute via payroll deductions and potentially benefit from a company match.

In these cases, you can drastically reduce your monthly premiums by switching to an HDHP and your tax liability via your contributions to the HSA. As a result, you can save a significant amount of money until you need it for medical expenses later in life.

If you don’t fit that profile, switching to an HDHP to open an HSA could cost you. For example, you’d likely be better off with an insurance plan that has a higher premium and lower deductible if you need to pay for expensive services in the near future.

💡 When in doubt, consider consulting a financial advisor or Certified Public Accountant. They can estimate how much you stand to save in taxes and help you make an informed decision.

Do you have any questions about HSA or how it works? Let us know in the comments below!

.png)

.com_public_images_2868477c-a648-4b35-9ee3-a4a35e0a1fc9_1000x667.jpeg)

.png)

.png)

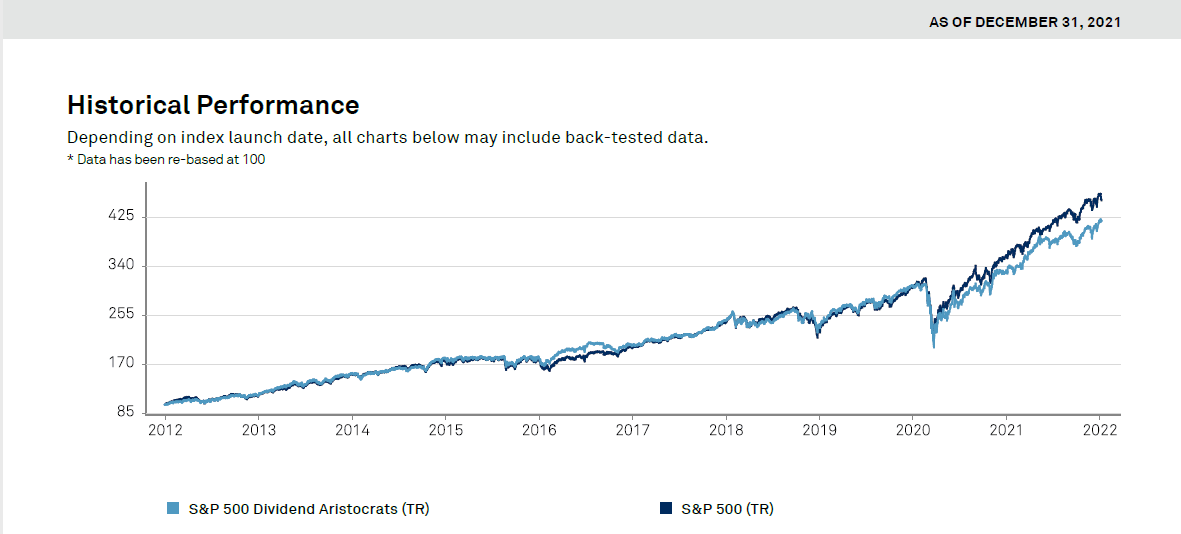

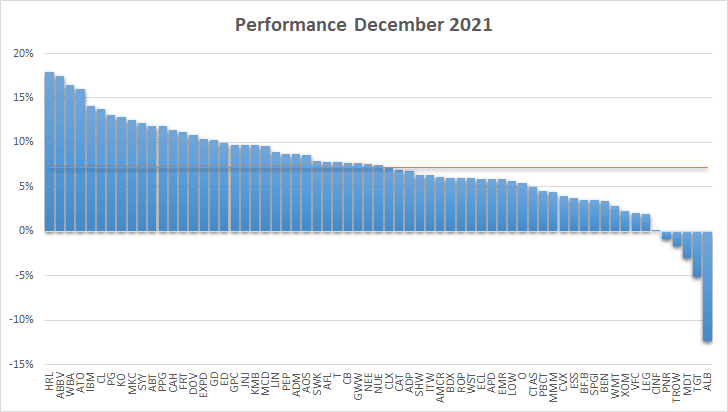

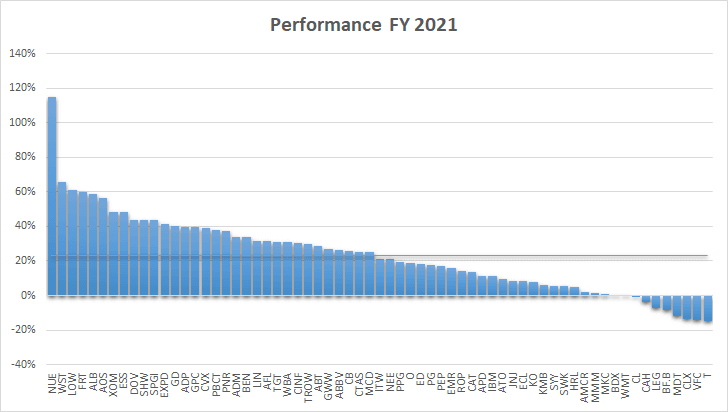

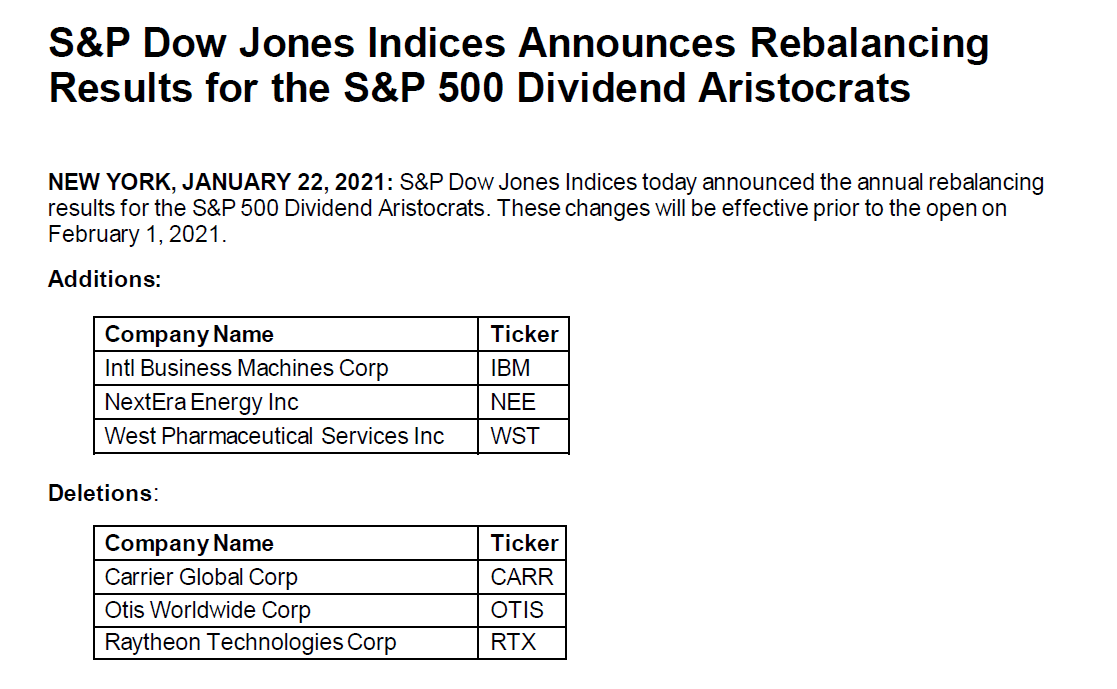

So, good to keep in mind that over a time period of 30 years

and multiple recessions, the dividend aristocrats’ strategy has outperformed the S&P 500 by

nearly 2% per year.

So, good to keep in mind that over a time period of 30 years

and multiple recessions, the dividend aristocrats’ strategy has outperformed the S&P 500 by

nearly 2% per year.

.png)

.png)

.png)